Turn innovation into opportunity.

Claim back up to 43.5% of your eligible R&D spend — without the paperwork pain.

15–30 minutes with Brett to review your current setup and next steps.

Flat-Fee Pricing

End-to-End Support

Xero Gold Partners

Financial Modelling for Growth

If you’re building something new, improving technology, or solving complex problems, there’s a good chance you’re doing eligible R&D. The R&D Tax Incentive rewards that innovation – and Good Ledger makes claiming it simple.

We help Australian businesses of all sizes access the R&D Tax Incentive with accuracy, speed, and confidence. From eligibility checks to final lodgement, our process is clear, compliant, and stress-free.

Years of Experience

We help businesses boost credibility and move forward with confidence.

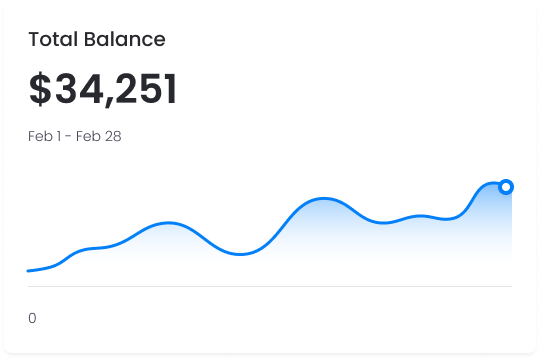

How the R&D Tax Incentive Works

If your turnover is under $20 million and you’re in a loss position, you could receive up to 43.5% of your eligible R&D spend as a cash refund.

If you’re profitable, you’ll receive an 18.5% tax offset.

Our promise: If we don’t proceed to lodgement, you don’t pay. Simple as that.

Eligibility Check

We assess whether your activities meet the government’s R&D criteria – focusing on experimentation, innovation, and measurable outcomes.

Documentation & Narrative

We help you clearly describe your R&D projects in a way that fits AusIndustry and ATO requirements, including technical summaries and experiment evidence.

Expense Calculation

We work with your bookkeeping and finance data to identify eligible expenses (at least $20,000 per year), such as salaries and Australian contractor costs, and overheads related to R&D.

Application Preparation & Lodgement

We prepare and lodge your full R&D application with AusIndustry and generate your ATO tax schedule, ensuring both align for seamless processing.

Registration & Refund

Once your application is registered before the 30 April deadline, your refund or offset is processed – usually within weeks.