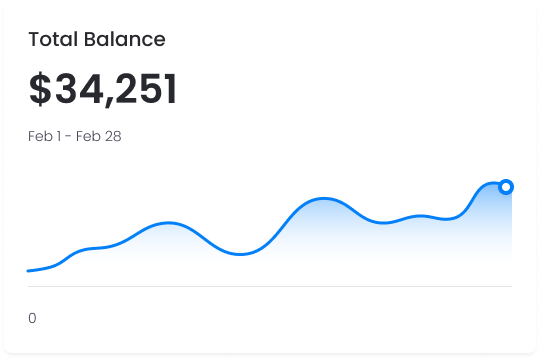

Know what your business is really worth.

Accurate, compliant, and defensible valuations that drive smart decisions.

15–30 minutes with Brett to review your current setup and next steps.

Raise Capital With Confidence

Equity Protection

Growth Planning

Financial Modelling for Growth

Whether you’re preparing to raise capital, launch an employee share plan, or plan for an exit, understanding your company’s true value is essential.

At Good Ledger, we deliver clear, data-backed valuations and financial models that give you (and your investors) confidence in every decision.

Years of Experience

We help businesses boost credibility and move forward with confidence.

Valuation Packages

We take the guesswork out of valuations by combining CPA-certified expertise, robust modelling, and practical insights that help you plan your next move.

NTA / Book Valuation

Ideal for small businesses or early-stage startups establishing Employee Share Schemes (ESS).

We perform an independent review of your accounts and underlying assets to produce a CPA-certified valuation report you can rely on.

You may qualify if:

- Your business is under seven years old or earns under $10M in annual revenue

- You haven’t raised more than $10M in the past 12 months

- You maintain financial reports

Includes:

- Independent review of financial statements

- Asset verification and reconciliation

- CPA-certified valuation report

Comprehensive Business Valuation

For established businesses preparing for fundraising, mergers, or exits.

We deliver a detailed, defendable valuation using multiple recognised methods and global data sources to ensure accuracy.

Includes:

- Five valuation methods for reliability

- Detailed valuation report with projections and rationale

- Scenario-based valuation range (base, optimistic, conservative)

- Two revision rounds within one month

Financial Modelling for Growth

Our financial models transform your data into clear, actionable insights.

We use advanced, cloud-based modelling tools to make your financials easy to interpret and update – no static spreadsheets, no surprises.

We’ll build models that help you:

- Forecast cash flow and profitability

- Evaluate pricing or expansion strategies

- Prepare investor-ready financial projections

- Support merger, acquisition, or funding decisions

*All pricing excludes GST. No lock-ins or hidden fees.